5 Reasons to NOT Apply for the US Bank Altitude Reserve

US Bank released a new credit card in the premium travel rewards card space yesterday. They call it the Chase Sapphire Reserve Killer US Bank Altitude Reserve Visa Infinite.

This card had a bit of hype to it the last few weeks, and I admit that I have definitely been keeping up with it. Plenty of people have already applied – including Mrs. Miles to Memories – and have been approved for this card.

Greg, over at Frequent Miler, has a comprehensive benefits guide and if you are interested in all the glitz and the glam that is the US Bank Altitude Reserve Visa Infinite, I suggest you head over there to learn more…

Because you won’t learn much over here, except why I am NOT (and why you should NOT) apply for this card!

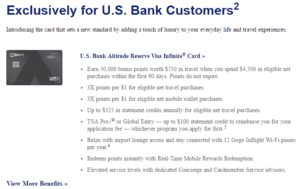

#1 – You must be a US Bank customer to get the card

I am not a US Bank customer. I would like to be, but it’s not that easy! As soon as the rumors of the “US Bank customers only” requirement started flying around, I applied for an Easy Checking account. While I knew I may have to wait the 35 days from account opening to be considered a customer, I was willing to miss out on the May 1st Opening Day and apply a bit late.

Let me tell you – it was not in fact, easy, to open an Easy Checking account.

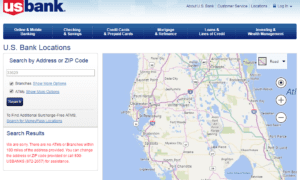

There are no US Bank locations in my area (TPA REPRESENT!), and therefore US Bank denied my checking account application.

While a credit card relationship could qualify me as a customer, US Bank has been known to deny applicants based on too many recent inquiries, so I am not sure applying for another US Bank credit card right now would improve my overall chances of approval on the Altitude.

I also read something about opening up a CD with US Bank, but I really don’t feel like bothering with that either… am I just being lazy?

#2 – The card comes with a $400 Annual Fee

That is a lot of money. I have been on record multiple times attempting to justify high annual fees on credit cards, mainly citing the accompanying benefits – specifically, annual travel credits. This card does come with a $325 annual travel credit to soften the blow, but either way you slice it, this annual fee means committing to more money spent.

Considering I already have committed to annual credits on various other credit cards totaling $900 ($300, $200 x2, and $100 x2), I am not sure I’m ready to tack on another $325… yet?

#3 – Doctor of Credit recommends you freeze SageStream & ARS credit reports

The hell is SageStream and/or ARS? I have no idea, and I have been avoiding US Bank for years due to this reason. Apparently US Bank pulls these lesser known credit reports and I have not given it the time to figure it all out.

I have actually read reports of applicants being denied for having these frozen, so I am not entirely sure if this is still the proper action to take pre-application? Anybody have any further thoughts on this?

#4 – There is no ability to transfer points to loyalty programs

This is not a deal breaker in itself, but if I am allowed to choose (and I am, because this is my life we are talking about here!), I will focus my attention on flexible award currencies like Membership Rewards, Ultimate Rewards, Starpoints, and/or ThankYou Points!

I get that the counter argument here is diversification. Why don’t I invest in both flexible currencies and these US Bank points? Great question…

For some it can be difficult to still earn these flexible award currencies given the various “rules” implemented by card issuers (i.e. Chase 5/24, Amex 1 per lifetime, etc.). For me, I am still somewhat within the “rules” for certain flexible point earning cards, and I won’t be diversifying until I am tapped out on those!

#5 – I can’t handle the denial right now…

I just have this feeling that I am going to get denied! I feel like I am going to go through all of this effort to try and get approved for this card and then when it comes down to it, I’ll be hit in the face with a big fat DENIAL letter!

From what I have read, US Bank is tough on credit card “churners” or those who apply for multiple cards in a limited period of time, and is very likely to deny folks in our hobby, despite high credit scores.

Denial is not just a river in Egypt – it is a very real possibility, and I am just not willing to apply and take that risk!

Final Thought

I am not going to apply for the US Bank Altitude Reserve credit card.

No way, man! Not gonna do it! Nope, never ever ever!

Despite all these reasons why NOT to apply for this card, if I start to hear great things from other credit card junkies, I am sure I will somehow rationalize my way into becoming eligible to apply for this thing!

Are you eligible to apply for the Altitude? Are you brave enough to apply!?

Am I wrong about any or all of the above? And can you convince me of it!? (Doubtful… not on the me being wrong, but on you being able to convince me that I am wrong…)

Happy Travels!

DW

![]()

$1050 in travel for $400 – come on now you can do it…..

Ok, ok… YOU CONVINCED ME! As you can see, I am easily convinced!

Are you going to apply!?

My reason for not applying is easy enough… there is no Visa Infinite $100 domestic discount!

Great point! That benefit could have swayed me towards an application as well!

I have a us bank credit card and check account, also have excellent credit, but when I applied the reserve card on the May 01, got denied due to so many inquiries in the last two years. So I’m planning close the credit card and checking account, play ” Life without us bank”!

By the way, my credit score is 820.

you have something else going on. I have opened 20+ cc’s in the past two years with 19 inquires showing up in the credit report, with low 700’s credit score (depending on which agency you ask) , and I still got approved with 18K limit. I’ve been a customer with US bank for almost a year, moderately above average income. Applied in branch. So appears there are more factors than your credit score that go into their equation.

Thanks for the comment. Very frustrating! I have a feeling I would have a very similar application experience… which is why I am avoiding!

Be Aware of the Extra hidden fees behind US Bank Altitude.

I got the card about a month, and charged above 4500 on it the first month. Among the charges were two cruises ticket. When the statement came, they didn’t apply the 325 credit. I called US Bank. they claim the charges went though as something else. I let that flight since i knew i was going to charge 325 before the year ends in another travel. Today I booked a flight to Chicago with the awarded 50k points. I made a mistake on one date and immediately call the bank. with less than 24 hours, the airline will have cancel or change my flight without penalty. US Bank charged me 30 dollars for their conscience service. Absolutely ridiculous, when Im paying 400 for a premium card.

I opened an account back in May with US Bank just so I could apply for this card. Although there is a US Bank just a few blocks from my house I never had any interest with them before until this card came out. I waited the 35 days and then applied. I got a notice on the computer screen that said pending. Then I got a letter saying I was rejected due to too many cards recently.

Then I went out of town for the summer and forgot about the card. But out of the blue my banker at US Bank called the other day asking if there was anything she could help with or if I was interested in opening up any other accounts or if I was interested in a home equity line of credit. (I wasn’t…). But then I remembered about the rejection letter.

So I told her and she said to come to her office and she would manually apply. I just did that this morning. She filled in all of the information on her computer and when she was done she said it had to go to underwriting. She said she would call me later in the day. Well, she just called and said I was approved with $35,000 limit.

So anyone getting rejected, I suggest if you can, go into a physical branch so the manager can help with it. For reference, I have a 815 FICO and opened up a checking account with $10,000. Not sure if that last part helped.

Thanks for the data point! Do you have any other premium cards?

the points are difficult to use. can’t use partial points if you are low on points.

total scam

Good article. However, there’s no other card setup that has my attention more than the “US Bank Trifecta” (i.e. Altitude Reserve + FlexPerks Gold + FlexPerks Travel Rewards).

Total earning is…

3X travel

3X mobile wallet

3X dining

2X gas

2X grocery

2X cell phone

1X everything else

Annual fees are…

$400 – $325 credit = $75

$85 – $25 credit = $60

$49 – $25 = $24

TOTAL = $159

I didn’t realize the lower fee cards had $25 air incidental credits. Pretty sweet.

Top it off with all points being worth 1.5¢ each toward travel regardless if you have the premium Altitude Reserve, and you’ve got yourself a darn good setup with low out-of-pocket fees 👍

Annnnnddd…….

With the new Real-Time Mobile Rewards feature, you can redeem points at 1.5¢ each *without* going through the US Bank travel portal. That means we can book directly with hotels, for example, to still earn elite credits & points, and then wipe out the charge at that high point value.

So…

Total earning is (toward travel):

4.5X travel

4.5X mobile wallet

4.5X dining

3X gas

3X grocery

3X cell phone

1.5X everything else

Gotta say…with Chase’s 5/245 Rule + 1 Sapphire Product Rule + 48-month Sapphire Bonus Rule…

This is the ultimate “interim combo”…or default combo for those who do a lot of domestic travel not requiring transfer partners.

What are your thoughts now having read all this? 😀

I was approved for the Altitude Reserve cars this past February and the benefits have been phenomenal. The $325 travel credit effectively cuts my annual fee to $75 but the benefits have gone beyond that. A trip to Japan and household spending easily got me past the 50,000pt bonus. However, the best part about the card has been the triple points multiplier on mobile payments like Apple Pay, Samsung Pay or Google Pay. Getting groceries and gas from Costco are key to taking advantage of the card. Keep in mind that you get $100 in VISA gift card for every 10,000 points you earn.