MUST HAVE: Chase Sapphire Preferred or Chase Sapphire Reserve

Question: “What is the best travel rewards credit card offer right now?”

Gosh I love this question! It’s so simple, and comes with such an easy answer!

Answer: One of two cards:

ONE: The Chase Sapphire Preferred Card – $95 annual fee (waived year 1)

TWO: The Chase Sapphire Reserve Card – $450 annual fee

What makes this question so easy?

How about the fact that is is supported by a laundry list of perks and benefits that provide great value to casual and expert travelers alike!

- 50,000 Ultimate Rewards point sign-up bonus – worth a minimum $625 (CSP) or $750 (CSR)

- The ability to redeem Chase Ultimate Rewards for a 25% (CSP)/50% (CSR) bonus

- 1:1 Point Transfer to Chase Transfer Partners

- 2x (CSP) or 3x (CSR) Earning on Dining & Travel Expenditures

- $300 Travel Credit (CSR)

- $100 Global Entry (or TSA Pre-Check) Fee Credit (CSR)

- Priority Pass Select Lounge Access (CSR)

- No Foreign Transaction Fees

- Primary Rental Car Insurance

- Free Roadside Assistance

- Trip Cancellation Insurance

- Trip Delay Insurance

- Baggage Delay Insurance

- Lost Luggage Reimbursement

- Travel Accident Insurance

- Purchase Protection

How to choose one over the other?

Well…

Can you max out the $300 annual travel credit?

If you leave your house at all, chances are that you will be able to utilize the full $300 annual travel credit. The credit is automatically applied to any and all travel charges.

That’s probably the most broad travel credit provided by any of the premium cards, and I am almost certain that you can achieve maximum $300 credit value each cardmember year!

That $300 credit softens that $450 annual fee to a net $150! So, if we are now at $150, and the next best option is the Chase Sapphire Preferred, we only need an additional $55 in value to justify holding the Reserve over the Preferred! (Remember that $55 magic number for later on…)

Will you redeem 22.5k Ultimate Rewards via Chase Travel Portal?

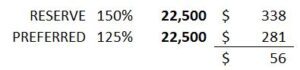

While it’s not the best thing you can do with your Ultimate Rewards, Chase Sapphire Reserve cardholders can redeem Chase Ultimate Rewards for a 50% bonus through the Chase Ultimate Rewards Portal. Compare that benefit to the 25% bonus available to with Sapphire Preferred cardholders.

With that difference in benefits in mind, it takes a redemption of just 22,500 points via the Chase Travel Portal for the Reserve to provide $56 more in travel value over the Preferred! Remember that $55 difference we pointed out above!?

MATH:

While transferring to travel partners is generally the best use of Ultimate Rewards, if you are the type of person to redeem through the Chase Travel Portal, this benefit may just be enough to justify paying the annual fee and keeping the Reserve over the Preferred long-term!

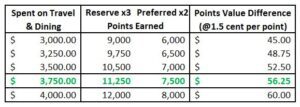

Can you spend $312.50 per month/$3,750.00 per year on travel & dining?

One of my favorites benefits of the Chase Sapphire Reserve is the additional points earned on the things I love the most – TRAVEL & DINING. The 3x earning on Dining & Travel expenditures is unrivaled in the premium credit card space, and is a full point over what is offered by the lower annual fee Chase Sapphire Preferred!

If you don’t travel and you don’t eat, I will question the reason you have this card in the first place, and will then admit that you may be better served by the Chase Sapphire Preferred.

BUT… if you spend enough money in the travel & dining category each year, it may just provide you with enough value to justify paying the $450 annual fee and holding the card long-term!

How much money exactly? Well…

MATH:

If I place a very modest value on Chase Ultimate Rewards of 1.5 cents per point, all you would need to do is spend $312.50 per month ($3,750.00 per year), in order for the Reserve to provide you that >$55 in value that we keep coming back to!

(Remember, $450 less $300 in travel credits, totals $150 – compared to the $95 annual fee on the Preferred, means value difference of $55 between the two cards!)

Yo quiero los dos?

Unfortunately, no can do, amigo!

This past August, Chase determined that all Sapphire cards are considered one family for the purposes of getting signup bonuses, which means that current Preferred or Reserve cardholders are not eligible to receive a bonus on any other Sapphire card.

Final Thought

If you have any interest in travel rewards, you NEED one of these two cards in your wallet. Period.

Whichever you choose is up to you… or maybe the card will just choose you!? No, I’m just kidding, you definitely will have to choose yourself. Credit cards don’t have the ability to choose their cardholder… that’s just silliness.

Are you a Chase Sapphire Preferred Cardholder? Or perhaps a Chase Sapphire Reserve Cardholder? If no, why the hell not!?

Happy Travels!

DW

![]()

You missed an obvious comparison point: how much value would you get from Priority Pass access to their lounge/restaurant network? If you’re trying to choose between the CSP and CSR, one trip for 2 to a restaurant for full credit ($28pp, or $56 total) covers the difference between the 2 cards. A few trips would actually cover the $150 on top of the travel credit. IMHO, if you’re going to fly main cabin to anywhere with PP lounges even a few times a year, it completes a full rebate of the annual fee.

Thanks for the comment!

I 100% agree that access to the Priority Pass lounge network, including access to rebates at select airport restaurants, is a valuable benefit and good reason to hold the Reserve, rather than the Preferred. The problem comes down to valuation, and what actual value you place on this benefit. While in your example you showed how a single trip to an in-network restaurant could cover the difference, not all travelers will transit through Denver, Portland, or Miami.

I achieve great value with the PP network, but there are others that may not leverage it based on their home airport and travel schedule.

There are many other areas where the CSR provides additional benefit value, but post attempted to limit the valuation piece of the equation, excluding many benefit differentials, and rather focused on the clear $ differences factoring in 2x/3x earning, and redemption at fixed value per point of 1.25 vs 1.5 cent per point.

Thanks!

DW