Chase Sapphire Reserve – Is it Worth it? Year 2

As we approach the beginning of year 2 of the Chase Sapphire Reserve, many of you are probably wondering whether or not to pay the $450 annual fee… (Don’t have this card yet!? GET IT! Everyone is doing it, even the Monkey himself!)

I mean sure… it was worth it in the beginning…

This time last August, a $450 annual fee could get you the following benefits:

Sign-up bonus of 100,000 Chase Ultimate rewards (currently 50,000) after $4,000 spending after 3 months! (Seriously people… 100,000 points! That was HUGE! I honestly cannot believe that they ever offered a point sign-up bonus that good…)

$300 Annual Travel Credit automatically applied to your account – includes airfare, hotel stays and more!

Lounge Access – Priority Pass Select (includes guest privileges)

$100 Global Entry (or TSA Pre-Check) Fee Credit

Redeem Chase Ultimate Rewards for a 50% bonus (compared to 25% with the Sapphire Preferred) through the Chase Ultimate Rewards Portal

1:1 Point Transfer to Chase Transfer Partners

3x Earning on Dining & Travel Expenditures

No Foreign Transaction Fees

Visa Infinite Benefits

I think that we can all agree that we achieved a very nice return on our investment in year 1!

But, here we are today… With no year 2 100,000 point sign-up bonus, and with our $100 Global Entry (or TSA Pre-Check) Fee Credit already spent. Two big value drivers, gone…

It is now on us to determine if the remaining year over year benefits of Chase Sapphire Reserve can provide us with enough value to justify the fee, or if it’s time for a downgrade to the Chase Sapphire Preferred ($95 annual fee).

How will we ever be able to determine this!? Well…

The Chase Sapphire Reserve is Worth Keeping Long-term IF:

You Can Max Out the $300 Annual Travel Credit

If you leave your house at all, chances are that you will be able to utilize the full $300 annual travel credit. The credit is automatically applied to any and all travel charges, which per Chase, include:

“airlines, hotels, motels, timeshares, campgrounds, car rental agencies, cruise lines, travel agencies, discount travel sites, and operators of passenger trains, buses, taxis, limousines, ferries, toll bridges and highways, and parking lots and garages. Please note that some merchants that provide transportation and travel-related services are not included in this category; for example, real estate agents, websites or owners that rent vacation properties, in-flight goods and services, on-board cruise line goods and services, sightseeing activities, tourist attractions, merchants within airports, and merchants that rent vehicles for the purpose of hauling.”

That’s probably the most broad travel credit provided by any of the premium cards, and I am almost certain that you can achieve maximum $300 credit value each cardmember year!

That $300 credit softens that $450 annual fee to a net $150! So, if we are now at $150, and the next best option is the Chase Sapphire Preferred, we only need an additional $55 in value to justify keeping the Reserve! (Remember that $55 magic number for later on…)

You Redeem 22.5k Ultimate Rewards via Chase Travel Portal

Chase Sapphire Reserve cardholders can redeem Chase Ultimate Rewards for a 50% bonus through the Chase Ultimate Rewards Portal. Compare that benefit to the 25% bonus available to with Sapphire Preferred cardholders!

With that difference in benefits in mind, it takes a redemption of just 22,500 points via the Chase Travel Portal for the Reserve to provide $56 more in travel value over the Preferred! Remember that $55 difference we pointed out above!?

MATH:

While transferring to travel partners is generally the best use of Ultimate Rewards, if you are the type of person to redeem through the Chase Travel Portal, this benefit may just be enough to justify paying the annual fee and keeping the Reserve long-term!

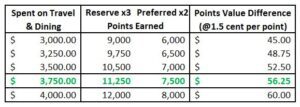

You Spend $312.50 per Month/$3750.00 per Year on Travel & Dining

One of my favorites benefits of the Chase Sapphire Reserve is the additional points earned on the things I love the most – TRAVEL & DINING. The 3x earning on Dining & Travel expenditures is unrivaled in the premium credit card space, and is a full point over what is offered by the lower annual fee Chase Sapphire Preferred!

If you don’t travel and you don’t eat, I will question the reason you have this card in the first place, and will then admit that you may be better served by the Chase Sapphire Preferred.

BUT… if you spend enough money in the travel & dining category each year, it may just provide you with enough value to justify paying the $450 annual fee and holding the card long-term!

How much money exactly? Well…

MATH:

If I place a very modest value on Chase Ultimate Rewards of 1.5 cents per point, all you would need to do is spend $312.50 per month ($3,750.00 per year), in order for the Reserve to provide you that >$55 in value that we keep coming back to!

(Remember, $450 less $300 in travel credits, totals $150 – compared to the $95 annual fee on the Preferred, means value difference of $55 between the two cards!)

Final Thought

The Chase Sapphire Reserve has been my favorite credit card this past year. Based on the analysis above, it seems that sentiment will continue!

I realize that $450 is a significant amount of money, but I truly believe that if you perform the analysis above, you will find a way to justify that investment another year!

While my analysis was performed for current Reserve cardholders, a similar type exercise can be performed if you are new to the Sapphire cards and are deciding between the Reserve and the Preferred – especially since Chase has decided to limit us all to only one Sapphire card!

What are your thoughts on Year 2 of the Chase Sapphire Reserve? Will you be paying another $450 to enjoy the Reserve lyfe!?

Happy Travels!

DW

![]()

Another thing to consider is the Purchase protection the Sapphire cards have to offer. The Reserve will protect your eligible personal property that has been damaged, stolen, or involuntary and accidental parting with property within 120 days from the date of purchase up to a maximum of $10,000 per claim and up to $50,000 per account , while the Preferred only covers only $500 per claim and $50,000 per account. Pretty much damaged, stolen, or lost items can be covered under this.

And I’m not sure if there is any differences for the Auto Rental Collision Damage Waiver between the two cards. I can’t find any detailed coverage plan for that.

Thanks for the additional comparison! Hard to put a value on those purchase protections until you actually need them, but when you do need them boy do they make a huge difference!

DW

You just can’t look at the numbers. You also need to look at the additional benefits offered by the Reserve versus the Preferred. The Reserve offers Priority Pass, better trip delay insurance, medical evacuation insurance and medical insurance.

Thanks for the note. And I agree that there are many other factors/benefits to take into consideration, though those are more difficult to quantify in pure $ value and are subject to each individuals valuation… if you can justify the fee based on spend and redemption via Chase portal, then the decision is clear and all of the other incremental benefits are in addition.

DW

I’ll use year 2 to get TSA Pre for my wife. I think that’ll work. Makes it worthwhile to keep, along with the other benefits.

What’s sad is in almost every value analysis I see about the CSR, Priority Pass is basically ignored or given an incredibly low value. Being based out of DFW I’ve found the PP lounge greatly inferior to Admirals Clubs, not to mention the Centurion lounge. I’d be interested in a CSR with slightly lower annual fee and no Priority Pass access.

Priority Pass is great, but easy to get as it is offered by a variety of credit cards. I agree with you though, a lesser fee with no PP would be better, as I rely on the Amex Platinum for all my Lounge Access – PP, Centurion & SkyClub.

DW