Credit is Your New Best Friend

“You have how many credit cards!?” they ask, as the look of astonishment sweeps their faces. As someone who is active in the points and miles game, I get this question all the time and though my answer varies depending on the day, my delivery is always the same – confident. “Currently 15, since I decided to close 1 this month…” and the jaws hang in free fall. A stigma exists around this credit card question: if someone has more than a couple cards, people tend to assume his credit must be bad, he must have so much debt, and he must be so irresponsible. But today I will explain to you how my 15 cards have increased my credit score over 75 points, North of 800, in just 2 years.

Aside from frequent travel (and by frequent I mean 4 days a week most weeks of the year), the easiest way to acquire frequent flyer miles and hotel points is to open a credit card (or 15 in my case) in order to take advantage of lucrative sign-up bonuses. Let me break it down for you… Think of credit cards and the world of miles and points as the bus to your school field trip… (stay with me here)…The bus will take you on the field trip to the theme park, just as long as you have your signed parent permission slip.

So what is the signed parent permission slip in the points and miles field trip?

Your Credit – and specifically, your Credit Score.

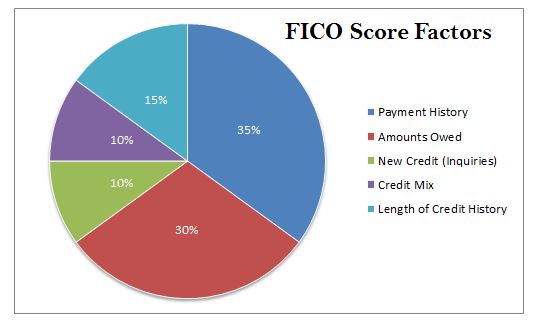

It will allow you to hop on the bus to the points and miles field trip where you can have the time of your life, but remember to pay close attention to that permission slip! Your credit score is comprised of multiple moving parts, which according to Credit Karma – a free credit monitoring site that I highly recommend – can be grouped into the following factors:

This is a rough illustration, but you can get a sense of each factor and the relative importance based on the size of the pie piece.

As you can see, the 2 most important factors are:

- Amounts Owed – Credit Card Utilization – the ratio of credit used/credit available (i.e. $1,000 credit card bill/$10,000 credit limit on the card = 10% Credit Card Utilization – the lower the % the better!)

- Payment History – paying your bills on-time, every time. This is where derogatory marks like late payments, bankruptcy, foreclosure, collections, tax liens, etc. come into play!

One factor I would like to highlight from the chart above is “Credit Inquiries” – which occur every time that a hard-pull on your credit is requested. The most common occurrence of a hard pull happens when applying for credit cards or applying for bank loans/mortgages. So when the aforementioned, gaping-mouthed folks were so astonished and worried at the beginning of the post – this is the factor that they are likely concerned about. They are worried that in order to get the 15 credit cards I have, I had to incur 15 hard credit pulls, which negatively impact my credit. What those folks do not understand, is that there are other more important factors (see 1 through 3 above) that are positively influenced by my shining new credit cards.

For example, let’s focus on that Credit Card Utilization Factor from #1 above. Let’s say currently your utilization is at 10% (remember: that means $1000 credit card bill/ $10,000 limit on the credit card), which is good, but nothing to brag about, but then suddenly you apply (and are approved) for another credit card with a $10,000 credit limit. Instantly, your credit card utilization went from 10% or ($1,000/$10,000) to 5% ($1,000/$20,000) and now the high weighted factor of Credit Card Utilization is considered excellent (rather than just good), while that low weighted factor of Credit Inquiries is considered Fair (a downgrade from Good) following the credit card application – Congratulations, your credit score just improved with your recent credit card approval!

Final Thought

Now, this is a simplified version of the whole process and I am not advocating for anyone to go out today and open 15 credit cards. What I am advocating is for you to all understand your credit score and the factors that go into it, while also taking advantage of your good credit to maximize your point and mile earning potential! I always will recommend that you apply for new credit cards only when you understand your score and understand what goes into it.

Leave any questions or comments below or email me at accountingyourpoints@yahoo.com

Happy Travels

DW

8 Comments