The Easiest 50,009 AAdvantage Miles I Ever Earned!

Fan of American Airlines AAdvantage miles? Yes, me too and I would like to share with you the easiest 50,009 AAdvantage miles I’ve ever earned…

With the AAdvantage Aviator Red World Elite Mastercard!

Step One – Application

Apply here my friends, and be on your way…

Remember, heed the Starter Guide and always practice safe credit card practices!

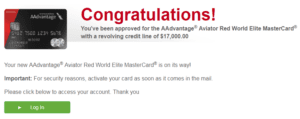

Step Two – Congratulations! Approval!

What an honor to be approved for such a great offer with such an upstanding financial institution!

Enter stage left…

I’d like to thank all the people whole supported, if it wasn’t for those people I would not be standing here today, an approved cardholder! I’d like to thank my family, my wife, and my little Chihuahua/Yorkshire terrier puppy. And most importantly, I would like to thank Barclaycard for making all of this possible and for allowing me to achieve all of my travel hopes and dreams!

And cue the playoff music…

Step Three – Make a Purchase – Any Purchase

I bought a Coke Zero at my favorite vending machine, paid for Tervis Tumbler to ship me a replacement cup, and prepaid $5 of my water bill. About $9 total – that’s triple the number of purchases requires to qualify for the initial 50k AAdvantage mile sign-up bonus!

I often find myself committing to tens of thousands of dollars in spending requirements in 3-6 month time periods, so the Aviator “any purchase” language is a welcome sight for sure!

Step Four – Pay Annual Fee

The annual fee is $95. It is not waived the first year…

JUST PAY IT!

$95 for 50,000 AAdvantage miles… that is a steal!

Step Five – Statement Close & Points are Yours!

Once your statement closes the AAdvantage miles will be on their way to your frequent flyer account (though they may take a day or two to show up in your account). Simple as that!

And here’s a tip – don’t wait until your statement closes to pay the fee! If you are able to pay down the balance (including the annual fee charge) prior to the statement close, you will earn the sign-up bonus on at your first statement closing!

And Remember – Don’t Cancel Your Current Aviator World Mastercard!

It won’t preclude an Aviator World Elite Mastercard!

That’s right people! Current Aviator cardholders converted over from the US Airways Mastercard have the “World” Mastercard version, while new Aviator applications are available only for the “World Elite” Mastercard. Since these are different cards, current Aviator World Mastercard cardholders still have the ability to earn 50,000 AAdvantage miles by applying for the AAdvantage Aviator World Elite Mastercard!

Final Thought

Earning tens of thousands of AAdvantage miles doesn’t have to be hard work. It can be a simple as an application, followed by a wee little single purchase!

Apply for the Barclaycard AAdvantage Aviator Red World Elite Mastercard and be on your way to 50k+ miles the easy way!

Earn miles, redeem miles, travel the world. Good Luck!

Happy travels!

DW

![]()

So the guy (an accountant!) spend 10min writing a blog about his CC application and the use of a CC to buy a coke. I mean,, are we kidding here? Is this how low Boarding Area has to go to find bloggers?

What a waste of bandwidth

It was a Coke Zero…

DW

Fee to replace a tervis cup? I’m in the wrong business. Ok announcing a new company offer. I’ve just contracted to make 50 cent plastic cups in China. Hipsters will buy them for $15 each at Kohl’s and when they go defective I’ll charge customers a big fee to replace them. How can I go wrong 🙂

You must have gone to business school…

DW

How churnable is this card?

More so than most… just have to space out applications 6 month increments to be safe and limit activity with other card issuers to avoid scrutiny

@Minos

It’s not BoardingArea, it’s Prior2Boardibg – think of a tricycle not a racing bike

Think Spirit Airlines, not Singapore Airlines Suites Class…

Thanks for posting this. My other Aviator card is due in December and they never cut me any slack on the annual fee. I will cancel that one and keep this one; 50K miles for $95 is fine for me. And it keeps me able to use the AA perks when I fly them (free bag and so forth…)

Solid plan! No reason to keep that old Aviator unless the fee is waived or if you have that 10k annual bonus associated with the legacy US Airways card!

DW

Emailed them (just got the card yesterday) and asked if I could get the NEW offer for 60K after paying the annual fee and buying something – they agreed! Thanks for alerting us of this original offer!

Dayyymm! I asked the same thing… no such luck :/ Good for you though!!

So I just got this card, but I also have the Citi AAdvantage card. Both of these cards offer 10% of redeemed miles back each year… does anyone know if I’ll get double (with 2 separate credit cards) or just one?

This benefit will only apply once, unfortunately no double dipping for those with cards from the two issuers!

DW