Minimum Spending > Chase Freedom 5x Spending

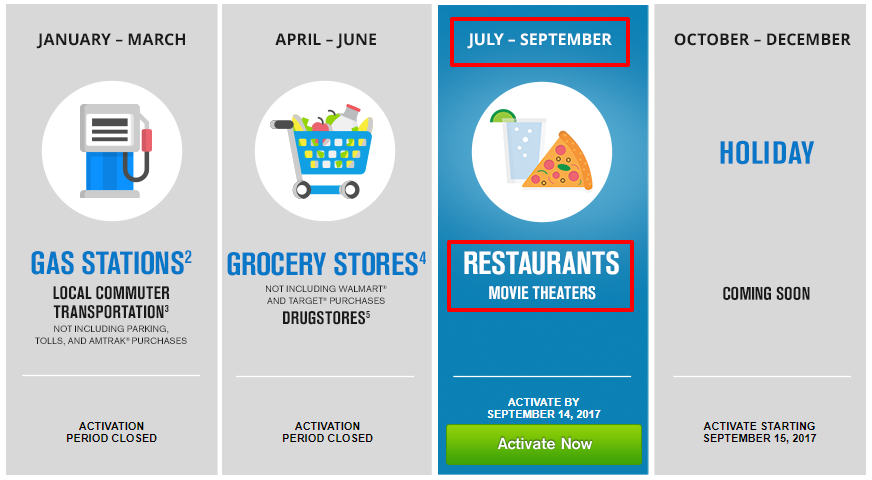

Hey you guys! Did you hear that Chase Freedom cardholders can earn 5x Chase Ultimate Rewards this quarter (July, August, September) on restaurant and movie theater spending?

Well you can! Seriously, 5x people! Consider it an early 4th of July present! Register here!

It’s America’s birthday, and yet Chase freedom cardholders are getting all of the presents!?

What’s better than 5x Chase Ultimate Rewards?

Well, how about 13.5x UR per dollar spent!?

Yes, that’s right my friends – it is possible to earn 13.5x UR! How, you ask? By signing up for the Chase Sapphire Preferred credit card and its 50,000 point sign-up bonus! Upon approval*, just $4,000 in spending will earn you a minimum of 54,000 UR!

*Approval not guaranteed – especially for those of us very much disqualified from the bonus given Chase 5/24!

Ok… I realize I am cheating a bit in comparing a quarterly promotional spending bonus on the Chase Freedom to that of arguably the best travel rewards credit card in the game – the Chase Sapphire Preferred – but hear me out!

Credit Card Sign-up Bonuses – The Best (& Fastest) Way to Accumulate Points & Miles

Don’t get me wrong, I love my Chase Freedom card! It was one of the first credit cards to ever make its way into my wallet and it remains there all these years later.

But I know I am not traveling the world, flying in premium class cabins, and staying in hotel suites because of the 5x spending on my Chase Freedom – capped at $1,500 in spending for a max of 7,500 bonus points per quarter…

Rather than spending $1,500 for 7,500 Ultimate Rewards, you could, and probably should, be focusing your spending efforts towards minimum spending on the Chase Sapphire Preferred, the Chase Sapphire Reserve, or any other travel rewards card that will help you achieve your travel dreams!

And when you achieve the minimum spending on a card like the Chase Sapphire Preferred, that just means that its time to move onto the next one!

Just follow my motto – A.B.M.S. – Always Be Minimum Spending!

Dont Get Carried Away – Pay your balances in FULL, EVERY month

This is very important. The points and miles that you earn will not be worth it if you carry a balance on your rewards credit card from month to month. Credit cards are notorious for charging lofty interest rates on credit card balances that are not paid in full each month, and these interest fees typically cost more than the worth of the miles you earned.

Don’t change your spending habits in the name of points and miles! Rather, change the cards that you spend with and truly maximize your rewards potential!

Final Thought

I love the Chase Freedom, and I love that I can earn 5x Ultimate Rewards at restaurants and movie theaters this quarter.

BUT…

I am currently working to meet minimum spend requirements on 3 separate credit cards that will provide me a much greater return on spending once I earn those valuable sign-up bonuses!

I’m not saying to stop using your Chase Freedom… I’m saying stop using your 5x points Chase Freedom and apply for a new rewards card today for 13.5x points per $1 spend (or more)!

Happy Travels!

DW

![]()

Hey Derek!

Spoke to my Chase banker the other day and am looking closely at the CSR. The point potential and benefits are huge, but I can’t help but to wonder about the offer AmEx tosses up with the Premier and Platinum cards,

I’ve been spending a lot on a card with no benefits and am ready to start getting rewarded. This site has proven extremely useful in the process!

Side note; I like taking frequent trips around the U.S. and don’t mind taking my time on a layover to hang in a lounge. I heard the Delta Lounge is one of the best and AmEx offers access to it. Should airline lounges have a say in the card I choose? Is the Chase one decent?

Hey Taylor! A couple things to consider in no particular order:

1. Lounges – both offer priority pass select membership, but the Amex Platinum offers Delta, which offers many more lounges across the US

2. Amex Relationship – Have you had the Amex Platinum in the past? Are you eligible/targeted for the 100k offer? Since Amex is one signup bonus per card per lifetime, make sure you have access to the 100k offer before applying for an inferior one

3. Chase 5/24 Status – Have you opened more than 4 credit cards in the last 24 months?

4. Consider an Amex Plat/Chase Sapphire Preferred combo – the CSP has may of the same benefits, the same sign-up of 50k Ultimate Rewards, but without the hefty annual fee!

I can send you some more details if you like, and I also have a post titled “Is the Amex Platinum Worth It?” that may be helpful in your decision making process!

DW