No More Chase Sapphire Reserve 100k Bonus… Now What?

Chase first announced the Sapphire Reserve and its MEGA 100k bonus last August and took me by surprise! Initially I was not sure how Chase was able to offer a card that provides so much more value than any other credit card available. But then I realized that Chase was promoting this product at a loss, to the tune of about $300 MILLION! Granted, Chase will likely recoup these costs over the product life-cycle… but $300 million!? Yikes!

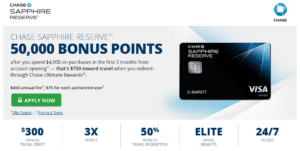

And that explains why as of mid-March, the public offer on the Chase Sapphire Reserve – both online and in-branch – is now just 50,000 Ultimate Reward points.

It was a good run… while it lasted…

The 100k bonus was not economical for Chase and couldn’t be sustained long-term. The 100k points were enough to get consumers excited about the product, leading to a very positive response and better than expected sign-ups, but now it’s time for Chase to make money.

No More Chase Sapphire Reserve 100k Bonus… Now What?

The 100k offer is gone, but the card is still active in the market and offers some rewarding benefits that you may still be interested in!

Here is a rundown of the card benefits:

- Sign-up bonus of 50,000 Chase Ultimate rewards after $4,000 spending within 3 months

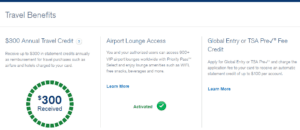

- $300 Annual Travel Credit automatically applied to your account – includes airfare, hotel stays and more!

- Lounge Access – Priority Pass Select (includes guest privileges)

- $100 Global Entry (or TSA Pre-Check) Fee Credit

- A $450 Annual Fee (Not Waived), $75 for Authorized Users

- Redeem Chase Ultimate Rewards for a 50% bonus (compared to 25% with the Sapphire Preferred) through the Chase Ultimate Rewards Portal

- 1:1 Point Transfer to Chase Transfer Partners

- 3x Earning on Dining & Travel Expenditures

- No Foreign Transaction Fees

- Visa Infinite

Note: If you happen to be a Chase Private Client, Doctor of Credit reports a “60,000 In-Branch Offer for Private Clients Starting March 12.”

Do the Benefits > the $450 Annual Fee?

Now that is something for you to decide! Remember, with the CSR those 50,000 points are worth at least $750 in travel though the Chase Travel Portal – and probably worth even more if transferred to Travel Partners.

Combine that value with some of the other perks and credits offered by the card, you may find yourself concluding 50k points + benefits > fee!

My Personal Advice?

For those able to:

- Maximize the $300 annual travel credit

- Utilize the TSA PreCheck/Global Entry Waiver

- Put significant spend towards the 3x Earning on Dining & Travel Expenditures categories

- Visit Priority Pass lounges around the world

Then this card may still be worth the $450 annual fee!

However, if you are someone who cannot achieve all or most of the above items, you may want to opt-out of this offer. Instead, consider the Chase Sapphire Preferred – offering the same number of Ultimate Rewards at 50,000, and similar benefits like transfer to travel partners and travel protections, but with an annual fee of just $95 (waived the first year).

A word of caution on both the Reserve and Preferred – the Chase 5/24 Rule is in effect! Make sure you know what this is and know what this means prior to any credit applications with Chase.

Final Thought

The best bonus on the Chase Sapphire Reserve – both online and in-branch – is now 50,000 after $4,000 spending in 3 months.

Whether the steep $450 annual fee (not waived the first year) payment is worth the investment – that is for you and you alone to decide!

All good things must come to an end. But, when one door closes, another one opens! If the current offer on the CSR is not for you, there are plenty of great credit card offers out there!

Did you miss out on the 100k CSR offer? Are you considering a sign-up and the reduced 50k offer?

Comment below or email me at accountingyourpoints@yahoo.com

Happy Travels!

DW

![]()

4 Comments