Why I Always Carry A Platinum Card, Should You?

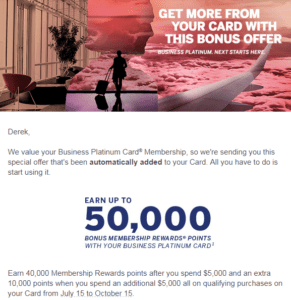

I am the proud carrier of an Amex Business Platinum Card. I have found the card to be incredibly rewarding over the course of this past ~1 year. Much of that value can be attributed to the now deceased 50% instant Membership Rewards rebate when booking with points via amextravel.com (now just 35% rebate with a delayed 6-10 weeks rebate timing).

We were all bummed on the 50% to 35% rebate devaluation, and while some of us (including myself) caught a break in that “New” Business Platinum cardholders (new, meaning customers who signed up October 5th through May 31, 2017) would continue to receive the 50% rebate for a full cardmember year, I was almost certain that my relationship with the Amex Platinum would end as soon as my 50% rebate benefit did…

But now, I am not so sure…

With all the noise in the premium travel rewards card market, we have seen Amex make big pushes to retain customers through spend bonuses and retention offers.

I am holding out hope that I will be on the receiving end of one of those retention offers as I move to close my card!

But if I am not, I just may hold onto my Business Platinum, or apply for one of the many personal Platinum versions (Platinum, Mercedes-Benz, Charles Schwab, Ameriprise, etc.).

Over the course of the past year I have come to realize that life without some version of the Amex Platinum is not a life that I want to lead!

I’ll be the first to admit, I was tough on Amex when the most recent changes to the Personal and Business versions of the Platinum Card were announced. I was frustrated, I was angry, and I just did not like American Express taking away things that I valued, adding benefits I didn’t care for, and jacking up the price (annual fee).

I went back and ran the math, and (personally) the price is still right year over year on both the personal Platinum Card(s) at $550 annually, and Business Platinum Card at $450 annually…

Here is why:

The Annual $200 Airline Fee Credit offsets the annual fee – bringing the fee down from $550 to $350 (personal) or $450 to $250 (business)!

Each calendar year, cardholders are eligible for a $200 airline fee reimbursement! You will have to select a valid airline prior to making a charge to use the credit and the reimbursement credit is NOT valid towards purchase of actual airfare. The credit is intended to offset fees (i.e. baggage fees, changes fees, seat assignment fees, etc.), however, there are many sources (AA, WN, UA, DL) suggesting that the purchase of low dollar value ($50-$100) airline gift cards directly from the airlines are able to trigger the credit.

Some will argue that this benefit should not be valued at the full $200 since it is limited to “airline fees”, though I have yet to have an issue with maximizing this benefit via seat selection or <$50 gift card purchases…

That $350 or $250 will buy you:

Unlimited Lounge Access

Delta SkyClub, American Express Centurion, & Priority Pass – As an American Express Platinum cardholder, you receive complementary access to all Centurion Lounges, Delta SkyClubs (when flying Delta Airlines), Airspaces Lounges and a Priority Pass Select Membership (see the Priority Pass Lounge network)!

Airport lounges provide a nice escape from the normal hustle and bustle of a busy airport and can also get you free, food, drinks and Wi-fi(depending on the lounge). The value of these perks really depends on the amount of travel you have through airports with SkyClub, Centurion, and Priority Pass lounges, but even if you only experience 3-4 lounge visits per year, this can be a difference maker!

Gold Status at Hilton, Starwood, AND MARRIOTT

As a Platinum cardholder you receive complimentary Gold status at both Hilton and Starwood chains, as well as Marriott Gold status now that the Starwood and Marriott programs are linked! While Gold status is not the top-tier status at any of these hotel brands, this mid-range status can earn you room upgrades, late check-out, point bonuses, premium internet, and even complimentary breakfast. The value of hotel status really depends on how much you stay at these hotel brands.

For frequent travelers, Gold Status at Hilton, SPG and Marriott can easily be worth $1,000+ per year, while leisurely travelers will achieve a much lower, but still very rewarding, value!

That’s not all folks! Specifically, the Personal versions of the Platinum Card also feature:

– $200 in annual Uber credits – $15 in Uber credits for U.S. rides every month plus a $20 bonus in December, directly through the Uber app.

I will work to maximize the value out of this, but wouldn’t label this as a straight forward $200 benefit value increase. There is also mention of Uber VIP status… whatever that is?

– 5x earning on airfare & hotel purchases made directly with airlines or on amextravel.com

While the business versions of the Platinum Card features:

– 35% Membership Rewards points rebate (after you use the Pay With Points feature on selected airline or First Class airfare). It’s not 50%… but it’s better than nothin’!

– 10 GoGo inflight wifi passes annually

Oh, and remember Membership Rewards!?

Duh! American Express Membership Rewards are valued anywhere from 1 cent per point (for flights booked through Amex Travel portal) to greater than 2 cents per point (if transferred to American Express Travel partners – like Singapore Airlines)!

The Platinum Card provides access to this sweet flexible reward currency!

And while the Premier Rewards Gold Amex provides similar access to transfer partners, I would argue the two cards work best in tandem at their respective spending bonus categories (5x airfare with the Platinum and 2x restaurants, gas stations & supermarkets).

There are other nits and nats here and there that provide additional benefits, but these are the real value drivers in my opinion! If you are interested in the laundry list of OTHER PERKS, you can find them discussed in more detail here, here, here and here!

Final Thought

The Amex Platinum has earned a forever spot in my wallet. While it may end up being a revolving door with various versions of the Platinum Card filling the slot, you can bet I’ll never leave home without it!

Whether you are an experienced points traveler or just getting started, don’t let that annual fee scare you. Leverage the benefits and drive the value to your liking!

Airline Credits, Lounge Access, Mid-tier Hotel Status – year in and year out, reason enough to carry the card!

Do you carry an Amex Platinum? Do you disagree that the card benefits outweigh the fee?

Happy Travels!

DW

![]()

I cancelled my Amex Pt because the increased fee did not add my value, (1) I will never use an Uber ever (2) last several times I have been to the Centurion Lounge (i.e. Miami), no place to sit, overcrowded, food good, line at the bar, etc [left and went to the Aadmiral’s Club which at least was quiet and peaceful (3) I do not travel with Delta. Post the 200 reimbursement from the “fees”, 350 dollars was not worth it.

What!? Never use an Uber ever? Not even the food delivery service UberEATS!? Even if you never want to take Uber, I’d argue that there is value added with the $200 worth of food delivery. I wouldn’t place the value at the full $200, but I believe it offsets the $100 increase.

Also… have you ever considered the Ameriprise version of the Platinum with no fee the first year?

Thanks for the comment!

DW

I use my Amex credit cards more than my Platinum card. All of them earn MR and in my case offers appear on the credit cards and not Plat. So unless I need to use Plat benefit, it stays in the drawer.

Agreed that the Platinum is not great for earning on everyday spend, but you should have it in your wallet whenever you travel for lounge access purposes!

Thanks for the note!

DW

I have been sooooooo tempted to try out Amex for a long time. However, I keep not pulling the trigger. The reason is trip cancellation and baggage delay insurances.

Look, I sure as hell not want to use these. But, when things happen, they happen (like, SFO caught on fire, and AS and SQ decided that they would lose track of their carts; yes, it happened). And having the insurance helps me feel a bit more confidence to book travel.

However, for all the glowing praises, Amex Platinum does NOT come with these. I remember telling my parents that their cards (they had Amex Pt) that their card must have already offered. I meant, even my lowly $95/yr CSR offered that!. Then I had to retract my recommendation later. Couldn’t believe it.

Look, the *only* way to make back the annual fee is to book travel (read: flights and hotels) with the card for the high return rate. However, since Amex doesn’t offer coverage, I can’t do that. Which means I keep defer trying out their supposedly legendary services. That said, Chase rocks. Just saying…