Only Cardholders Truly Benefiting from Amex Platinum Changes

It all started last week when American Express announced MAJOR, Yet Not-So Rewarding Changes to their Platinum Card beginning March 30th, including:

- $200 annual Uber credits

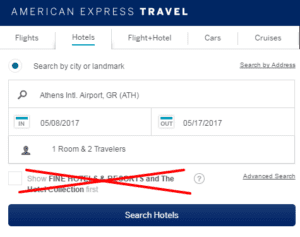

- 5x earning on eligible hotel bookings (i.e. via amextravel.com)

- Improved Priority Pass guest access (2 free guests privileges)

- Plus come other junk like: Complimentary Additional Gold Cards, Expansion of the Global Lounge Collection, Access to a new Global Dining Collection

Oh and a $100 increase in the annual fee! Making it a staggering $550 per year!

Then, a few days later, we learned from our ‘ol pal Gary at View from the Wing that…

American Express was introducing the following changes to the Business Platinum, effective March 30th:

- 5x earning on eligible air and hotel bookings (i.e. via amextravel.com)

- Improved Priority Pass guest access (2 free guests privileges)

- Plus come other junk like: Expansion of the Global Lounge Collection & Access to a new Global Dining Collection

The good news here was that the annual fee on OPEN Business Platinum would remain at just $450 per year.

(Although I am skeptical of this fee in the long-term and believe a jump to $550 is imminent…)

The Added Benefits Are Blah…

If American Express is attempting to gain/retain cardholders (which I assume they are) and compete with rivals like Chase’s Sapphire Reserve and Ink Preferred, there needs to be a focus on offering incremental benefits. Offering new unrewarding benefits or additional benefits offset by a corresponding fee hike is not going to get you where you want to be!

And yet, there is one very rewarding SWEET spot…

The Platinum Card® from American Express for Ameriprise Financial

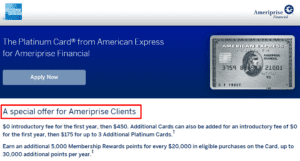

Of the products to receive the new benefits, the Ameriprise version of the Amex Platinum is the only one that will not be subject to the new increased $550 annual fee… for the first year, that is! The Ameriprise version of the Amex Platinum offers all the same benefits of the other personal Platinum versions, but with the first year annual fee waived!

That means you’ll enjoy the following existing benefits:

- $200 annual airline fee credit

- Access to American Express Fine Hotels & Resorts

- Access to Delta SkyClubs, American Express Centurion Lounges, & a Priority Pass Select membership

- Global Entry/TSA PreCheck fee credit

- Access to Boingo hotspots

- Gold Status at Hilton, Starwood and now Marriott (via Status Match!)

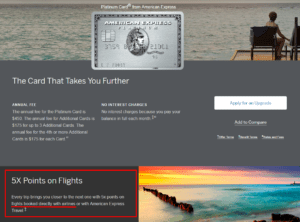

- 5x earning on airfare for purchases made directly with airlines or on amextravel.com

Plus the new personal card benefits, effective after March 30th:

- $200 annual Uber credit

- 5x earning on eligible hotel bookings (i.e. via amextravel.com)

- Improved Priority Pass guest access (2 free guests privileges)

- Plus come other junk like: Complimentary Additional Gold Cards, Expansion of the Global Lounge Collection, Access to a new Global Dining Collection

- AND A METAL CARD!

All for a $0 first year annual fee for you and up to 3 additional cardholders.

Note: Following the first year, you will be subject to the $550 annual fee and $175 additional cardholder fee (for up to 3 additional cardholders)

Before you jump all over this, there are some very important things to note…

1) There is NO sign-up bonus on The Platinum Card from American Express for Ameriprise

2) The Platinum Card from American Express for Ameriprise Financial is its own separate product – meaning a sign-up will not preclude you from a future “once per lifetime bonus on the Platinum Card.”

3) The Platinum Card from American Express for Ameriprise Financial is NOT for everyone!

Per the Offer Terms – You MUST be an Ameriprise Financial Client:

“The Platinum Card® from American Express is issued by American Express Bank, FSB. ©2016 American Express Bank, FSB. All rights reserved. Your ability to have this Card product is contingent on a relationship between you and Ameriprise Financial, Inc. If no relationship exists, or if your relationship with Ameriprise Financial ends, American Express has the right to cancel your Card account or transfer your account to another American Express Card product that will have different features and benefits.”

Not an Ameriprise client? Well, perhaps it’s time to consider a relationship! Rollover a 401k or open an investment account and fund a minimum amount to avoid fees! Whatever you do, I highly recommend additional research via flyertalk in order to ensure that your Ameriprise relationship qualifies you to become a cardholder per the terms above!

Final Thought

Overall, I think American Express missed with their recent Platinum and Business Platinum benefit changes. There was an opportunity for Amex to come out and really shine, especially with the Chase Sapphire Reserve hype cooling down pending the bonus decrease.

MOST Platinum cardholders will end up neither much better nor worse off given these changes (although, I still think the $550 annual fee is a ridiculous price to pay), but if you happen to be an Ameriprise client, The Platinum Card from American Express for Ameriprise Financial just received a nice 1st year benefit boost!

Are you an Ameriprise client that can take advantage of this offer? Are you interested in becoming one for this offer!?

Happy Travels!

DW

I’m waiting until my annual in Nov to Cancel. Very sad but no longer worth it. Especially since I didn’t receive any bonus because when I went to cancel the offered me the Platinum as a retention. I missed a lot of MR points. $200 in baggage fees and WiFi and food on a predetermined airline is not worth it. Lounges are not everywhere. I’m in Virginia and travel to Fort Lauderdale so strike 3. There is no UBER near me. $550 is a Joke. Chase is so much better