Does Chase Trip Delay Reimbursement Work? Part 2

I recently experienced a flight cancellation on my way home from Colorado Springs (See PART 1). It was a major bummer, but it provided me the perfect opportunity to test out a certain credit card benefit…

Chase trip Delay Reimbursement!

Per the Chase Sapphire Reserve benefits guide:

“If your common carrier travel is delayed more than 6 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket.”

So… I booked a cheap room at the Home2 Suites near the Denver Airport, and attempted to evoke this travel benefit to recoup the $120 or so that I spent due to the delay caused by American Airlines.

Upon further research, I stumbled upon a very helpful Reddit thread on the subject – titled “a guide to the chase trip delay benefit.” The thread is very detailed with information on required documentation, filing the claim, and what to do after you file.

Based on this thread, there was much more required in the way of documentation than I would have initially expected, but I was determined to get my $$$ back!

Filing a Claim

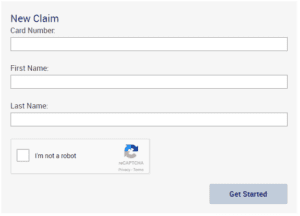

While the benefits guide instructs cardholders to call Chase directly, filing a claim is actually more simple than that! Just head over to eclaimsline.com and follow instructions!

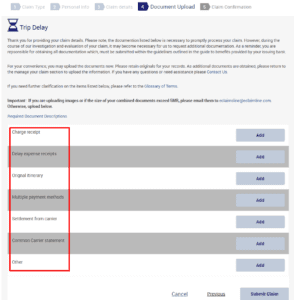

Required Documentation

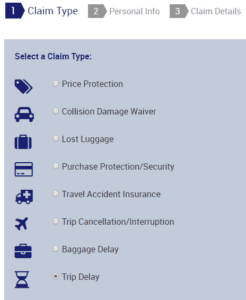

The Chase Sapphire Reserve benefits guide details the required documentation as follows:

Your completed and signed claim form

Check! I completed & e-signed the form at eclaimsline.com

Your Account receipt showing that the travel fare was charged to your eligible card – i.e. your credit card statement. (Remember – in order to utilize this benefit, you had to pay some portion of the ticket cost with your Chase card!)

Check! Attached a copy of my card statement showing the charge to American Airlines.

A copy of the Common Carrier ticket – the original round-trip itinerary (including the delayed segment), as well as the new portion of the round-trip itinerary flown.

Check! Attached my Southwest TPA-DEN receipt, my COS-TPA receipt (the cancelled segment), and my DEN-TPA receipt (the rescheduled segment actually flown).

Note – Your “round-trip” airfare does not have to be on a single record locator, or even with a single airline.

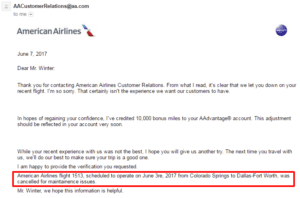

A statement from the Common Carrier indicating the reasons that the Covered Trip was delayed.

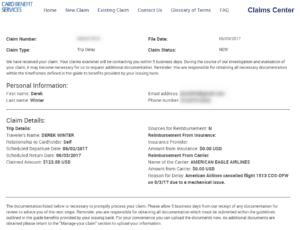

Check, but this is probably the toughest item to collect! In order to get this I submitted a complaint to Customer Relations via American Airlines online contact form. I specifically requested the AA rep to confirm reason for the flight cancellation, and was delighted with the response I received just a week later…

Copies of receipts for the claimed expenses.

Check! Attached a copy of my Home2 Suites folio. I used my CSR for the hotel stay, though this is not a requirement for you to be reimbursed.

Any other documentation deemed necessary, in the Benefit Administrator’s sole discretion, to substantiate the claim.

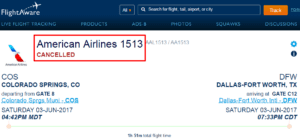

This is where you include any and all additional info supporting your claim! You can never provide too much information, so I decided to include screenshots of the cancellation per the Flight Aware website, as well as my Twitter conversations with an AA representative.

Here is how those requirements translate within the eclaimsline.com:

My Chase Trip Delay Reimbursement Result

It worked! My claim was approved! Just two days after submitting all of the required documentation, I received the following response from the claims department:

![The image shows an email from "Card Benefit Services Claim" with the subject "Re: Benefit Claim." The email is addressed to "Dear [name]," and it informs the recipient that their claim for the Trip Delay Benefit has been approved. The email states that the recipient will receive a check for $315.00 within the next 7 to 10 business days. It also mentions that the check represents the covered expenses that the recipient incurred due to the delay. The email concludes by inviting the recipient to reach out if they have any questions. The email is timestamped at 3:12 PM on August 1, 2023.](https://accountingyourpoints.boardingarea.com/wp-content/uploads/2017/06/eclaimsline.com-Claim-7-Approval-300x77.png)

APPROVED! Now I just have to wait 7-10 business days to receive my check!

One interesting piece of the email received was the reference to the fact that my specific reimbursement request represented “reasonable expenses that [I] incurred due to the delay.” If I decided to stay at the Westin for double the nightly rate, would I still be reimbursed? If I would have included a steak dinner in my reimbursement request, would that still be deemed “reasonable?” Good question!?

Final Thought

While I have yet to receive the actual funds, I am ready to confirm that the Chase Trip Delay Reimbursement benefit provided by my Chase Sapphire Reserve does in fact “WORK!” It is a bit of a process and requires documentation and organization, but in the end your efforts should be rewarded!

A quick recap:

Step 1: Pay for travel with your Chase Sapphire Reserve Card

Step 2: Incur a travel delay over 6 hours/overnight – document the delay. This includes requesting a statement from the carrier documenting the reason for delay.

Step 3: Make “reasonable” purchases – hotel, food, essentials, etc. – keep your receipts!

Step 4: Head to eclaimsline.com and file a claim. Make sure to attach any and all supporting documentation.

Step 5: Reimbursement! Or provide more information if requested…

I will note, however, that you should keep your delay expenses to a “reasonable” level, regardless of the $500 allowance. Don’t spend with the assumption that Chase will automatically reimburse you! Be frugal, spend what you need to in order to get by (food, hotel, etc.), and keep good records!

What has been your experience with Chase trip delay reimbursement? Have you ever been successful and/or unsuccessful in utilizing this card benefit!?

Happy Travels!

DW

![]()

Awesome post and very helpful! Most people don’t know/think to use this. Will definitely keep this in mind next time I’m delayed!

Any idea what reimbursement might be like if I have paid for the entirety of my trip with points?

Great question! I would check out the Reddit thread linked within the post. There are some great data points there and it should provide you a good basis to set an expectation.

Thanks for this post. Great information.

Can you please elaborate on your Note – Your “round-trip” airfare does not have to be on a single record locator, or even with a single airline.

So if i buy 2 one ways on different airlines they would still cover?

Yes! The Chase Benefits Guide defines a “covered trip” as:A Covered Trip is a period of round-trip travel (meaning departing from and eventually returning to your primary residence) that doesn’t exceed three hundred and sixty- five (365) days away from your residence to a destination other than your city of residence. Therefore, as long as you aren’t moving away and not returning for over a year, your trip should be covered. Whether the travel is booked on a single airline with a single record locator or across multiple carriers across multiple locators, you should be covered. I booked my trip flying Southwest Airlines from TPA-DEN and then booked the return on American Airlines and it was covered!

DW

Not it doesn’t really work as advertised. Missed a connection in MIA, Chase refusing to cover my overnight expenses because they state AA’s delay reason is not covered. The following was the rationale provide by AA: “American Airlines flight 1565 scheduled to operate on May 10 from Orlando to Miami was delayed for crew.”

Pretty disappointed, kinda feel it’s rather scam’ish on behalf of Chase S. Reserve. It ain’t a cheap card.