Goodbye Chase Hyatt Credit Card… For Now?

Goodbyes are tough. I don’t like saying goodbyes. I don’t feel great about saying goodbye to my Chase Hyatt credit card, but I have determined that it has to be done. And while I am sad that we have to go our separate ways, I am hopeful that we may be reunited again very soon…

But for now, let’s focus on the all the good times that we had together! Like how we first met!

Why I applied for the card?

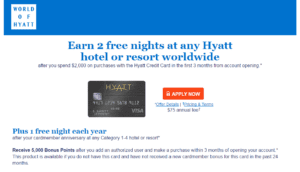

Back when I applied, The Hyatt Credit Card (Chase) offered a very lucrative sign-up bonus of 2 Free Night Certificates (for stays at any Hyatt worldwide) after spending $1,000 in 3 months from account opening, with an additional 5,000 bonus points awarded after adding an authorized user. Since then, the spending requirement has bumped up to $2,000 in 3 months, an incremental price to pay for this wowser of a deal considering these certificates can be redeemed at top tier Hyatt properties!

I was able to redeem my free night certificates at The Park Hyatt Paris Vendome – which can cost between $639 – $1,217 per night (Based on Average Rates for a Standard Room), and given my experience there, I was very satisfied with my decision to get this card!

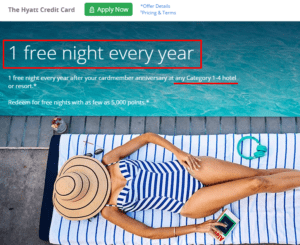

What made the card worth holding on until now has been the 1 free night every year after your cardmember anniversary at any Category 1-4 property (like my recent Hyatt Regency Osaka stay) – which makes the card more than worth the $75 annual fee.

Outside of meeting the minimum spend, I never found myself spending on this card, considering Hyatt is a transfer partner of the Chase and it is much easier to accumulate Hyatt Gold Passport points by spending on the CSR and transferring to your Hyatt loyalty account.

Why I cancelled the card?

It was taking up space – both in reference to the physical space that it occupied, as well as the $8k in credit line that it occupied with Chase.

But wait, the more credit, the better… right? Kinda…

I know, I know… I typically advise people to retain credit lines by transferring credit between multiple accounts with an issuer, this was different.

While the $8k in credit has a positive influence on my utilization ratio, I am at the upper limit of credit extended by Chase. Cancelling the card with the $8k credit line should free me up available credit for future applications with Chase, and increase my chances of auto-approval.

UPDATE: Reader Tri pointed out in the comments section that a better move to make would be to lower the existing limit prior to canceling the card. If you cancel without lowering the credit limit, the original credit line is still tied up for awhile. Lowering the credit limit is better since it gets updated quicker (and “refiltered” for use), compared to an entire account closure.

A little spring cleaning is great and all, but freeing up available space with Chase doesn’t do me much good, unless I intend to apply for another Chase card – which brings me to the main reason for cancelling this card!

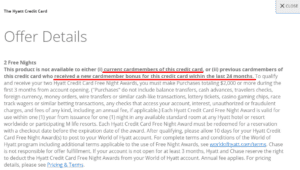

According to the offer details on this card –

“This product is not available to either (i) current cardmembers of this credit card, or (ii) previous cardmembers of this credit card who received a new cardmember bonus for this credit card within the last 24 months.”

Cancelling this card satisfies (i), and I just realized that the last time I received a bonus on this card was in late 2014, meaning (ii) is also a non-factor! That means I can apply for this card again and be eligible for the sweet a$$ 2 free night sign-up bonus!

Note: I did recently come across something on Doctor of Credit’s site advising applicants to wait a month or so to let the card clear out of their profile, ensuring you are not identified as a current cardholder. I will be following this advice!

Will I be approved?

Survey says!? Doubtful.

I may technically be eligible to earn the sign-up bonus, that is contingent on me being approved for the card. With the exception of my CSR application, which was approved through an in-branch pre-approval sign-up, I have steered clear of Chase for fear of the 5/24 rule and certain denial.

Potentially lucky for me, the Chase Hyatt is one of the few Chase credit cards not subject to 5/24. That means my frequent credit card applications over the course of the past 2 years shouldn’t preclude me from approval. That said, I am not particularly confident.

I’ll keep you posted on how the application goes, whether I experience instant approval, reconsideration (begging), or denial, we are in this together!

Final Thought

I cancelled my Chase Hyatt card. I intend to apply again in a month and am already day-dreaming about 2-night stays at high-end Park Hyatt properties around the world!

While I hope for approval, I do not feel great about my chances given my past with Chase… which includes 2 denials – one on the Marriott Rewards card and one on the Chase Ink Plus. I was lucky enough to snag the CSR at its peak, but lightning never rarely(?) strikes the same place twice!

Why are more people not doing this? Is there something I’m missing?

Is this a bad idea (any and all advice welcome – HELP ME)!?

Does anyone have experience churning Chase credit cards following the 24-month window?

How about the Chase Hyatt credit card specifically?

Happy Travels!

DW

![]()

Derek – IF in fact this does work, this is absolutely Brilliant! I almost feel like this would be too good to be true – and yes, as an ethical Blogger you will want to share it with your readers. I think this is worth digging into on the terms of the Other Chase Cards to see if their “24 month” language is identical. I do have a theory on “Why is Nobody Else talking about this?” – If I were Chase and one of my Affiliate network bloggers were to talk about this, I think I would (as Chase) go ballistic on them – they would basically be encouraging behaviour that would amount to “churning” – from Chase’s perspective anyway.

of course it will work… however what you should have done is wind down the credit limit first (move CL to lowest possible)… wait a bit and then close the account. the original credit line is still tied up for a while. Lowering the CL is better since it gets updated quicker (and “refiltered” for use) than an entire closure. Probably want to look into that next time newbie. hit up DoC for details.

Appreciate the comment. I am aware of the process you are referring to and use it frequently with BoA. You’re right that I should have followed the same protocol for Chase, mistake on my part! Lucky for me I met someone like you who knows everything to point out when mess up 😉

ha! sarcasm noted. but i think you did a disservice in not recommending the “better” way to close an account.

Noted! I’ll update shortly so other readers can benefit… thanks for the note!

The 24 month rule applies to the Sapphire Preferred card as well which, in my opinion, has a much better sign-up bonus than the Hyatt card. I cancelled the Sapphire Preferred I got in 2014, applied again, and got approved last month. Looking forward to adding another 50K UR points, transferring them to my CSR, and multiplying their value to $750. Don’t forget to let a friend with a Sapphire Preferred card refer you so they can get 10K UR points. Refer theme once you get your card and bingo you get another $150 bonus.

Love this idea! It had never occurred to me that I could cancel a card and reapply and get the bonus a second time. Thanks so much for the tip!