My Amex Fee Credit Applied to Airfare?

What a glorious morning!

You know that feeling you get when you find that unexpected wadded up $20 bill in your pocket?

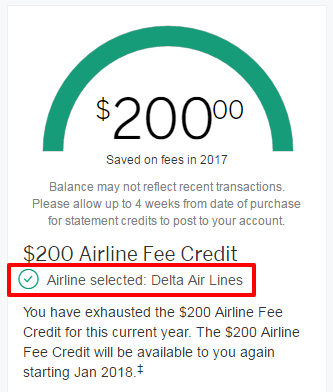

Well for me, this morning went a little something like that – all thanks to American Express – as it seems a recent Delta airfare purchase qualified for my Platinum Airline Fee Credit!

Why is this a BIG DEAL?

Well, because it represents a much more effective and efficient redemption of the Annual $200 Airline Fee Credit!

The Annual $200 credit is intended to offset fees (i.e. baggage fees, changes fees, seat assignment fees, etc.). It is NOT valid towards purchase of actual airfare.

For your reference, the Benefit Terms:

Incidental air travel fees must be separate charges from airline ticket charges. Airline tickets, upgrades, mileage points purchases, mileage points transfer fees, gift cards, duty free purchases, and award tickets are not deemed to be incidental fees.

Historically, the workaround to these strict terms has been to purchase of low dollar value ($50-$100) airline gift cards directly from the airlines. This sly move has typically are able to trigger the credit (see Flyertalk discussions for more on this).

This is the exact process I followed in December for my 2016 $200 Airline Fee Reimbursements…

What does this mean for the future!?

It could mean 1 of 2 things…

The 1st Possibility –

American Express has decided to further improve their premium card benefit offerings to compete with the likes of Citi’s Prestige card and current bell of the ball – Chase’s Sapphire Reserve! Smart move – good on you American Express!

And we thought the 5x earning on airfare purchases was good!

Both the Citi and Chase premium cards feature annual credits that apply to actual airfare expenses ($250 Prestige) or general travel expenses ($300 CSR). American Express is behind the pack here with their much less user friendly “airline fee” reimbursement credit on the Platinum and Premier Rewards Gold cards – which specifically excludes airfare.

This move would make sense for American Express and would definitely help shift from focus away from Chase and Citi…

The 2nd (and more likely) Possibility –

American Express screwed up. For some reason my purchase was treated differently than typical airfare purchases and triggered the credit.

Chalk it up to dumb luck.

Final Thought

This is just a single data point. I am not ready to claim this as an attempt for Amex to align with competitor premium cards (like the Chase Sapphire Reserve). Maybe Amex will make the move and allow credits to be received for actual air-travel, and maybe they won’t…

But after just writing it and then reading it aloud a couple times, it does seem like a smart move for American Express… right!?

Happy Travels!

DW

![]()