What NOT to Do: Redeem Chase Ultimate Rewards for Cash

I know, I know… cash is king. While it may be applicable to certain business or investment decisions, it DOES NOT apply to the world of points and miles! I recently witnessed a friend (who will remain nameless to preserve his/her identity/reputation) redeem Chase Ultimate Rewards points for cash back… to then “offset” a 2-night hotel stay… I kid you not…

Point and mile collectors know to ignore cash, and focus on value. My friend did not have this same inclination, so today we are going to help him/her and any other out there focus on Chase Ultimate Reward redemption value!

A Chase Ultimate Reward Redemption Value Comparison:

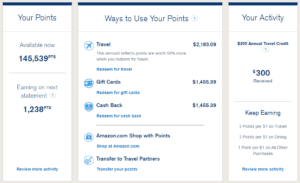

Chase Ultimate Rewards points are some of the most valuable and flexible points on the market, mostly due to their flexibility! Don’t be fooled! While that flexibility may include redeeming for cash, it should not be your first, or second thought – let’s check out a quick redemption value comparison to illustrate!

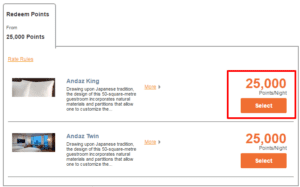

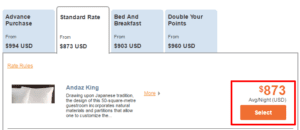

Transfer to Travel Partner – Hyatt: 100,000 Chase Ultimate Rewards for 4 Nights at the Andaz Tokyo Toranomon Hills

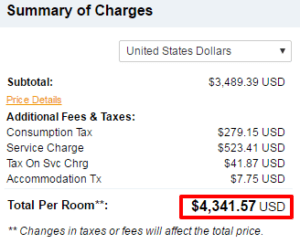

Ya… $873! And that is before taxes and fees! Here is the actual estimate for the 4 night stay…

That is over $4,000 in “value” for 100,000 Chase Ultimate Rewards points, meaning a redemption rate of over 4 cents per point! Now, critics of “point valuations” will argue that I would have never stayed at the Andaz at over $800 per night, and therefore the redemption is not really worth $4,000.

Those critics would be correct! I will NEVER pay that much per night.

So, while I agree the 4 cent per point value may be a stretch, the redemption did result in 4 free nights in a luxury hotel in a pricey Tokyo during the ever popular sakura (cherry blossom) season, and that is pretty dang impressive! Let’s be conservative here and peg the value of this redemption at 2 cents per point.

Redemption Value: Over 2 cents per point!

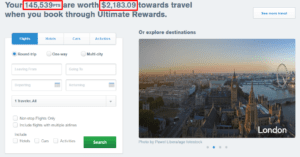

Redeem through Chase Ultimate Rewards Travel Portal:

For those of you that are unfamiliar, the Chase Ultimate Rewards Portal allows you to book travel using points based on the actual price of travel. Once you have selected your travel (flights/hotel/rental cars) you can then redeem Chase Ultimate Reward points at the standard rate of 1.25 cents per point (for Sapphire Preferred, Chase Ink Preferred, and Chase Ink Plus cardholders), or if you have the Chase Sapphire Reserve you can redeem Chase at a standard rate of 1.5 cents per point (rather than the CSP rate of .0125)!

While redemptions at 1.25 and 1.5 cents per point are significantly less than some potential redemptions with Chase Travel Partners (see above), they still provide an “Ok” value and are great for those that value flexibility and/or redemption on non-Chase Travel Partners (like Delta and American Airlines)!

Redemption Value: 1.25 – 1.5 cents per point

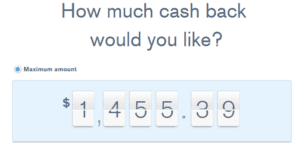

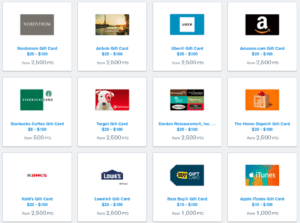

Liquidate – Convert Points to Cash and/or Gift Cards:

Blah, people. Just BLAH, BLAH, BLAH! Why be a cardholder of a Chase Ultimate Rewards earning card if you are just going to piss away at least 20-33% of the point value!

I love cash and I love gift cards, and the offers are tempting…

But snap out of it!

This is NOT a good redemption, despite how much you love your Starbucks Mocha Latte!

Redemption Value: 1.00 cent per point… NO GOOD, friends!

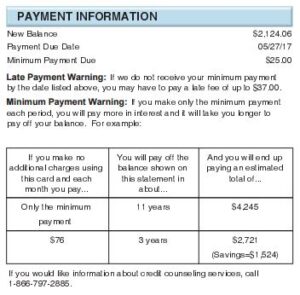

The One and Only Reason to Redeem for Cash:

If you are carrying a balance and paying interest fees!

This is very important. The points and miles that you earn will not be worth it if you carry a balance on your rewards credit card from month to month. Credit cards are notorious for charging lofty interest rates on credit card balances that are not paid in full each month, and these interest fees typically cost more than the worth of the miles you earned. Don’t change your spending habits in the name of points and miles! You can change the way you pay for things but don’t spend more than you would if you were using the wad of cash that used to fill your wallet.

Is this your first time considering this? Head to the Starter Guide for more into tips!

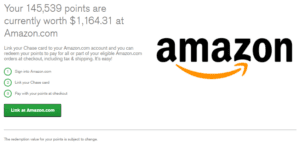

Worst and Last – Redeem on Amazon…

There is only one thing worse than redeeming Chase Ultimate Reward points for cash back… Amazon! I’m a loud and proud Amazon Prime member, but why would you ever do this?

If you are considering this redemption, you are dead to me…

Redemption Value: 0.8 cents per point

Final Thought

Please, oh please! DO NOT redeem your ever-so-valuable Chase Ultimate Rewards for cash back, gift cards, or through Amazon.

Seriously… if I find out that you redeemed Chase Ultimate Reward points during your Amazon purchase of laundry detergent and a phone charger for your car, I will absolutely LOSE IT! And de-friend you! And if we aren’t friends, I will become friends with you, only to subsequently de-friend you, citing your shi**y Ultimate Reward point redemption as the reason…

Hopefully I have made myself clear here and you will think twice before making a terrible point redemption in the near or distant future!

Happy Travels!

DW

![]()

I’m an avid budget traveller and although I understand that my points technically have more value when used to book travel they don’t give access to the budget options. Why would I spend 4500 points to stay in a 3-star hotel when I can book an incredible airbnb for $25/night. I recently was looking for roundtrip flights from Dublin, Ireland to Naples, Italy, If booked through Chase travel I would spend over 20,000 points on the trip to fly with Aer Lingus, I found the very same flights with RyanAir for $80 roundtrip. I’m honestly looking for a reason to not cash out my points but I cannot find a time to spend them where I won’t end up spending 30-50% more when giving them 1:1 valuation. PLEASE give me a reason to hold onto my points!

The comment above is true.

Chase points are a scam for true budget travelers because the flights they offer don’t include low-cost prices of carriers like Spirit, and the accommodations are also not the most affordable. Quick Google searches reveal this time and again.

I also wonder if I should use my card to purchase a airline ticket which will earn me 3x the points value with my reserve card. Then use my points at a 1-1 ratio as credit towards my card balance. Seems as though earning 3x the points then spending 1-1 versus using points to book at 1.5 to 1 value and not earning any more points would be a better strategy? Anybody have any feedback?

Accumulated points, whether for cash or other rewards, do not earn interest while they’re sitting in your points balance. I always redeem my points monthly for cash into my high-yield savings account that earns me 2% interest.

Well, what if I want to book a hotel room using the chase LHR collection to get $100 hotel credit, free breakfast for 2 , early/late check-in/out and one level upgrade benefits.

I cant book it using Ultimate reward points. I either have to pay cash or get cash back and use it on LHRC to make it a 1:1 transfer of UR points. Will this justifiable option ?

Well, what if I want to book a hotel room using the chase LHR collection to get $100 hotel credit, free breakfast for 2 , early/late check-in/out and one level upgrade benefits.

I cant book it using Ultimate reward points. I either have to pay cash or get cash back and use it on LHRC to make it a 1:1 transfer of UR points. Will this justifiable option?

Also now that no one can travel and who knows how long it will be until anyone can travel “normally” again, cash is looking like a better option right now, especially when money’s tight.

i have a glut of UR points which continues to increase much faster than i am able to use. this and that these are unusual times, i will be converting some UR pts cash to throw into investments.

Thank you so much for your clear explanations. I had just tried calling Chase to find out why I had to redeem 3750 points for $30 on Amazon. (I had thought it would be an even 3,000). Tried to get answers from 2 different reps, who both kept me on HOLD for a long time and then I got disconnected – so frustrating for such a simple explanation! I really appreciate being able to find this out online.