How will a student loan balance transfer impact credit?

I had a friend ask an interesting question this weekend about a balance transfer. His thought was to move his student loans to a credit card with a new balance transfer offer of 0% for the first year and then pay the credit card off in 3-6 months. His interest rate would be lower than that associated with his student loans, but he wanted to know what else he should consider before pulling the trigger on this opportunity.

To be honest, I didn’t know the answer off the top of my head. This was not a situation I had ever considered. How would this affect his credit?

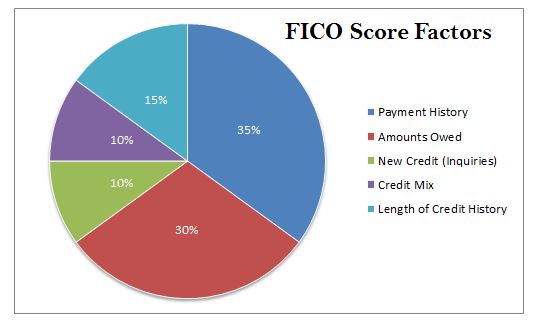

When you look at how a credit score is calculated, there are multiple factors that are considered, but some are weighted more heavily than others. The three areas with the heaviest weight, or that will make the biggest difference, are your credit utilization, your on-time payment history and the number of derogatory marks on your credit report.

Credit utilization is a calculation showing what percentage of the credit you have available you are using.

The reasoning here is that if you’re using all of the credit available to you, or a higher percentage of it, you are a greater credit risk. Even if you’re spending the same amount per month, and paying it off in full, if you don’t have enough available credit, this factor will pull down your credit score. An easy example is someone who spends $1,000 per month and has $5,000 in available credit has a credit utilization score of 20%. If that same person were to have $20,000 in available credit, they would have a credit utilization score of 5%. If you use credit responsibly, call your credit cards and ask for an increase in your credit limit, there’s no hard inquiry for this and it can drastically improve your credit score.

In my friend’s case, increasing his balance by transferring those loans would significantly increase the percentage of credit he’s utilizing. Depending on when the balance was paid down, this could have a drastic long-term affect.

Your on-time payment history is as straightforward as it sounds.

If you miss a payment, it will affect your credit score. Going hand-in-hand with this factor, but with less of an impact on your credit score, is your length of credit history. The longer you’ve had credit open, which is an average of all of your open accounts, including any car loans and home loans, the better your score. Tying this back into your on-time payment history, if you have a long credit history, you will have made more payments over that history, thus diminishing the impact of a late payment. The most important thing here is to make sure you are able to make your payments on time!

In the instance of the student loans balance transfer, as long as payments were made appropriately, on-time payment history should not be affected. However, in closing out the student loans and opening a credit card, the length of credit history WOULD be affected. A newer card would lower that average and the age of the student loans would freeze which would also lower that average until the loans were removed from the credit report. This is why it can be helpful to make one of your early cards a “no-fee” card that you can leave open indefinitely.

My first card was actually the Chase Freedom (apply here for $150 cash back bonus) which I still have open. While it may not be one of the top cards on most lists, the rotating 5% cash back categories coupled with the Chase Sapphire Reserve give me 5x the Ultimate Rewards in categories I might not normally have a multiplier in. This quarter includes grocery, drug stores and last year saw gas stations, restaurants (5x is still better than the 3x on CSR!) and even online shopping. It’s helped my credit to leave it open, I haven’t had to pay annual fees, and I do get some use out of!

The last area with the strongest impact on your credit score is the area of derogatory marks.

These are essentially “bad comments” on your credit report. These could be bankruptcies, accounts in collections, foreclosures and other “warnings” to credit issuers. Unless my friend was defaulting on his loans, a simple balance transfer should not have an impact on this area of the calculation.

My suggestion for the transferring of student loans was for my friend to check out the credit simulation tool on Credit Karma to figure out what would work best for him. He was looking at saving a substantial amount of interest, but it would likely have some negative impact on his credit score.

Credit is an amazing tool and can help you travel inexpensively and in high style when used appropriately. Understanding credit and the factors that affect it are crucial to playing the points and miles game. Whether you’re churning cards every quarter or just looking for the right few cards to build a stash, it’s important to not only review your credit regularly, but to understand how each choice you make affects your credit in both the short and long term.

JS

Wouldn’t the main issue be AAoA, which would be negatively impacted if he pays off his student loans in full? I recently paid down my highest interest rate student loans with Plastiq to meet min spend, but I was careful not to pay it off completely, so I can keep the account open.

Thanks for the note. It may impact AAoA, but in the overall credit calculation AAoA is a very small factor. Personally, my AAoA is only 1-2 years, but my overall score is up around 800.

It’s be nice a see a plug for the free annual credit that we’re entitled to here. But isn’t credit utilization just checked at the time the creditor pulls your credit report when you apply?

If he’s paid it off by then, the fact he used up most of his available credit shouldn’t hurt him-and might make him looked upon more favorably by people as he’s shown he can pay off large amounts of debt.

Thanks for the note! Unfortunately your credit report is not always kept up to date in real-time and there can be lapses of time where utilization is off due to timing of reporting by creditor to the credit bureaus.

DW

My friend paid off his $35k student loans with an inheritance and his credit score dropped nearly 45pts. I understand the why….but still think it’s obscene that paying your debts is hurtful to your score.

If your friend is sure he will pay the balance back in 3-6 months, it will not have a “drastic long term effect” at all. Creditors update your utilization monthly. FICO has no memory when it comes to utilization, so once he’s paid it off, a month or two out it will be like it never happened (for the utilization component).

And if your friend takes much longer to pay it down, his biggest problem is not his credit utilization score, it’s the fact that he’ll have traded a low-to-medium interest loan for a high interest credit card loan.

The point of a good credit score is to benefit financially. Unless there’s something he needs a good credit score for MORE in that time frame, like a mortgage, it makes no sense to pay a lot more interest just to avoid a temporary drop in credit score.

Also, yes, some credit card issuers do a hard inquiry when you ask for a credit increase. I think they tell you first, but not positive about that part.

Depending on the amount of credit limit he has, this could wreck his credit. Also, mix is a factor in credit scores as well. When I paid off my student loans and auto loan within months of each other, this lowered my score a bit since I no longer had installment loans… just mortgages (home and rentals) and credit cards. Banks and credit bureaus like to see a mix of credit. That being said, I am still glad I paid off my auto and student loans when I did. Now, working on paying off all mortgages!

A few months ago, I ended up paying $5k to my student loan as a balance transfer from a zero interest offer. My credit score went down 25 points probably because this increased my credit utilization. Since I was trying to save on interest (and now my credit score) I spent the next few months paying off both as I had $8k left. Credit score pretty much back to what it was, paying it off didn’t improve the score any..