Say Hello to Another New Chase Hyatt Credit Card

It wasn’t too long ago now that I said goodbye to my Chase Hyatt Visa…

While I loved the card for the initial sign-up bonus of 2 free nights at any Hyatt property worldwide, I never used the card.

What made the card worth holding on until now has been the 1 free night every year after your cardmember anniversary at any Category 1-4 property (like my recent Hyatt Regency Osaka stay). It made the card more than worth the $75 annual fee, but I had grown tired of the planning it took to redeem at just the right property. Maybe it is just me, but locating a Category 1-4 Hyatt property in just the right destination did’t prove to be an easy task!

So, I dumped my Chase Hyatt Visa…

It’s not you Chase Hyatt… it’s me. I just really need some time alone right now to work on myself. I will always treasure the times we had together at The Park Hyatt Paris Vendome, where we used those free night certificates to save between $639 – $1,217 per night (Based on Average Rates for a Standard Room).

So long, farewall, goodbye, until we meet again…

The Goodbye was not meant to last…

Though I cancelled the card, I did so with the full intention to apply for another Chase Hyatt card!

While Chase bank is definitely not a “churn-friendly” credit issuer, the sign-up bonus on the Chase Hyatt card is one that can theoretically be had again and again:

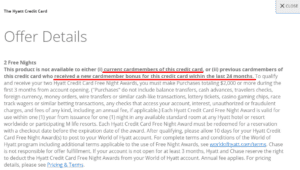

According to the offer details on this card –

“This product is not available to either (i) current cardmembers of this credit card, or (ii) previous cardmembers of this credit card who received a new cardmember bonus for this credit card within the last 24 months.”

Our Separation Didn’t Last! Just 12 Days Later…

I couldn’t take it! I just had to have another 2 free nights and 5,000 Hyatt points after adding an authorized user! I couldn’t eat, I couldn’t sleep, and I couldn’t even use the bathroom until I had my hands on that card again! Ok, a bit of an exaggeration, but you get it – I wanted the card again and did not want to wait, considering I have a redemption in mind that I want to secure ASAP!

What About Chase 5/24?

Great question! This rule means most Chase cards are off limits to those of us who have opened 5 cards or more in the past 2 years, but there are a few Chase cards that this rule DOES NOT apply to (yet?)!

The Chase Hyatt card happens to be one of those cards that does not fall under the tyranny of Chase 5/24!

Doctor of Credit has the full rundown of cards not governed by 5/24…

The Decision

Pending… Of course the application went into pending status! The days of my instant approval on credit cards are loooong gone, and I really was not expecting anything different this time around.

I did not call Chase, but instead decided to wait it out. I used to be a big fan of the reconsideration line and believed that if I could just plead my case to a human, I could convince him/her of my card worthiness on the spot and get an approval much faster. This was effective at one point in time, but it began to work less and less, and therefore I moved to a passive “wait and see” strategy!

So, I waited… and then something great happened!

I logged onto my Chase account this weekend, and noticed something a little different – my new Chase Hyatt card was approved with a $5,000 credit line and was already waiting patiently in my Chase account!

I then called up the application status automated line – 800-436-7927 – and confirmed my approval!

Eligible for the Bonus?

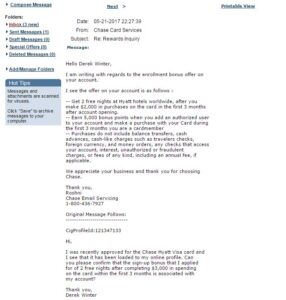

The approval was the biggest hurdle to clear, and I SOARED over it! BUT, even with the approval in hand, I still wanted to confirm my eligibility for the bonus (given my deviation from the Doctor of Credit advice). I sent a secure message over to Chase to confirm the bonus and…

Eureka!

Based on the response I received, i am in fact eligible for the sign-up bonus, and now it is just a matter of spending $2,000 in the next 3 months! Easy peasy!

Final Thought

I parted ways with the Chase Hyatt. But, that goodbye didn’t last long! Since the last time I received the bonus was OVER 24 months ago, I was technically eligible to earn the sign-up bonus of 2 free night certificates. So, I applied, I was approved, I confirmed my bonus eligibility, and now I am on my way to 2 free nights at the Hyatt property of my choosing!

If you have been a Chase Hyatt cardholder for over 2 years, I strongly suggest you follow my strategy! Cancel your current card, and reapply to earn another 2 free nights at any Hyatt property!

Why don’t I read more about this!? Is this obvious to everyone else but I am just catching on!?

Happy Travels!

DW

![]()

Short turn around! I had read that Chase would reopen closed accounts if applying within 30 days of closing the same card. This is a great data point!

I read similar things… Probably too aggressive on my part, but I was happy to get that confirmation from Chase regarding the bonus! We will see if I actually receive the bonus after reaching the minimum spend, but luckily I can point back to the secure message from Chase!

Possible correction: As I understand it, it’s more than 4 cards, not more than 5. I.e. if you’ve had more than 4 cards, you will get denied.

Agreed. “More than 4 cards” or “5 cards or more.” Thanks!

Just had a few questions – how many days did you wait before it showed up in your account? Also, by any chance do you recall if your monthly statement date fell within that 12 day period? Lastly, did you transfer your full credit line to another card or you just closed the card with the credit line intact? Thanks!

Am I reading if I have opened more than 5 cards I will get denied? I don’t want to lose my free night or my Hyatt card if so. I have a great credit score, but I def take advantage of credit card offers.

No, this card is not subject to the Chase 5/24 rule!